On Money and Currency: The USD is Unconstitutional and Other Things That Have Already Happened

Life, Liberty, and the Pursuit of Happiness Through Sound Money

It is with a humble reluctance that I offer these words for the public consideration.

Alas, too much time has passed that we have born silent witness. I can no longer idly watch as the crumbling remains of this once-great republic are imprisoned by weak men.

I hereby call-to-pen all “be-ings” with equal or greater conviction. We no longer have the luxury to remain idle. Recent times have proven that our current form of Government has become destructive of those ends which were once ratified in our name by the forefathers of this great nation- ends we find enshrined in the Declaration of Independence. Namely: the unalienable right to Life, Liberty, and the Pursuit of Happiness.

Whenever any Form of Government becomes destructive of these ends, it is the Right of the People to alter or abolish it, and to institute a new Government. The first amendment to the constitution states that it is the right of the people peaceably to assemble, and to petition the Government for a redress of grievances. The time for a redress of grievances came and went in 2008. Our political leaders dared to pretend we could stop time without injuring eternity. I would like to warn that math is an unforgiving mistress- for Math, like physics, reigns supreme- regardless of our capacity to fathom it so.

Let us for a moment consider the possibility that our current Form of Government, which is made of fallible individuals, has been co-opted by bad blood. Let us entertain that the “blood” beating through the heart of such corruption is a phantasmagoria keeping us from recognizing the truth. A forgery perhaps directly at odds with our constitution and the guarantees contained therein. Perhaps, it is possible that we have all been duped- including our leaders- to abandon our means to Life, Liberty, and The Pursuit of Happiness.

I dare to suppose this “blood” has been co-opted by an evil which acts openly to divest us of our Liberty. If this were found to be true, “We The People of the United States” have an obligation to throw off such evil.

Such has been the patient sufferance of history, and such is now the necessity which binds us to history’s repeated cycle. It is with great reverence that I express my patriotism to the ideals embodied by this republic. This call-to-pen is just that- an act of patriotism.

To any thinking individual, it is quite obvious that this ancient, imperial war-machine is broken. To understand how, we must grapple with several inconvenient truths. To prove this, let Facts be submitted to a candid world.

My thesis is simple: Our fiat “money” system is divesting all of us of our right to Life, Liberty, and the Pursuit of Happiness. It is unconstitutional and we have a constitutional right and moral obligation to abolish it.

One might attempt to argue that money is the tool we use to acquire the very things which we need to survive. How could it be divesting us of our liberty? We’ll piece together this idea as we explore how our current currency system is structured, in actuality. There is a problem with it, and we are being gaslighted- but why?

I think political leaders honestly cannot fathom a solution, even though many understand the problem.

It is hard to be motivated to solve a problem for someone else when you gain inherent benefits by not solving the problem.

Such is the nature of the beast. The problem is an intrinsic, mathematically guaranteed feature of fiat currency, not some tamable disfunction, as we are often lead to believe by politicians and financial institutions.

What I’m talking about is inflation. The way inflation functions is to deprive us of our liberty. Whether that is intentional or not is not my concern. I’m not here to make speculations; I’m on a rampage to reveal the truth.

As a nation, We needed to have a conversation about money and currency, yesterday.

Money is the underlying tool we use to measure and communicate how a society values the myriad of ways that individuals spend their time. I believe a functional economy should enable prosperity across the land, allow for diversification of labor, and aid us in redistributing the fruits of our cumulative efforts in a way that makes sense, respects personal property, and incentivizes production.

I believe a good money can enable people to find a balance between laborious pursuits and the pursuit of creative and self-centric ends.

Money is a tool we use to barter across time and space, and without a coincidence of needs; it is a measuring stick of the shared values of a society. It is the primary means we use to enable us to exercise our right to private property.

Across history, money has generally gravitated towards very specific forms. The recent evolution of fiat currency should be seen as an attack on the foundation of our society and the republic, and WE have an obligation to fight to overthrow the current monetary order.

Sound money is an integral part of the right to Life, Liberty, and The Pursuit of Happiness, as we will soon explore. Fiat currency as it currently exists, is a direct threat to the ideals our country was founded upon, and possibly the single greatest threat to freedom and democracy the world has ever seen.

The Fifth Amendment of the U.S. Constitution provides that "[n]o person shall be ... deprived of life, liberty or property without due process of law; nor shall private property be taken for public use, without just compensation."

With current advances in technology happening faster than most people can comprehend, any semblance of freedom we still retain is rapidly disappearing. The waning of the Imperial American Empire is one that our founders warned us against with no uncertain tone. We have allowed our minds to be co-opted, and it is not by mistake that we’ve ended up here.

One must simply follow the incentives of our society to uncover the truth.

Without a philosophical dive into the evolution and nature of money and currency, an appreciation of its current disfunction is impossible. Money is generally regarded as being outside of our comprehension, beyond our sphere of control, and something best left to banks and governments. This attitude is dangerous, and has not been the case for much of history. There was a time when individuals were greatly concerned about money, and representative leaders won or lost elections- or were overthrown and executed- due to their positions on monetary issues. An understanding of the nature of money has been allowed to fade from the public consciousness.

At its essence, money is anything which is accepted as a medium of exchange. If we wish to use money we possess now, but in the future, good money therefore needs to also hold a relatively stable value. Medium of exchange. Store of value. These are the functions of money.

Let us break it down further, money takes many forms: commodity money, receipt money, fractional money, and fiat money. The differences between each are nuanced and important.

Before we had a commonly agreed upon money like gold, and before governments forced us to accept intrinsically worthless pieces of currency through the designation of “legal tender” laws, we bartered with goods directly. I might give you two goats for your pig. You could offer me bundles of cured wood which I need to survive winter for my excess harvested grain from summer.

This system functioned great as long as there was a shared coincidence of needs. In the absence of mutual needs, we need technology to escrow value. Often, if there is something tangible that is in high mutual demand, it will become monetary technology, de-facto.

If someone believes they can exchange a good for something else of value at a later time, that good becomes a store of value. When the transaction actually takes place, that money is serving as a medium of exchange.

When the value society agrees upon is drawn from something that has a real-world-use, or some value outside of being only a monetary good, we call it “commodity money”. Things such as livestock and food served as commodity money, because they always had value to people.

As metals became more commonly refined and smithed, they began to be used as a medium of exchange. Chunks of metal were valued by their weight and purity, and became the first form of coins. Large amounts of labor and energy had to go into the harvesting, refining, and production of metals, so there was a sense of “Proof of Work” behind the value of the metal.

This provided a generally agreed upon medium of exchange, representing the effort of many souls. People generally agreed refined metals had value, because production of the good required significant work in the physical world. Inevitably, smashing those lumps flatter to stack and store made sense, and coinage was born in its current form. Coinage is a form of currency which also functions as commodity money.

Because coins are more “durable” over time, and more easily transported than, say, cows, they became a shared medium of exchange for nearly all merchants and traders. At the root, money provides a store of value and medium of exchange. The verifiable purity of metals and precisely measurable weight made metal the ideal store of value on every continent, due to its “fungibility”. An ounce of pure gold from any continent was equal to an ounce of gold from another.

Paper currency evolved as a receipt from a goldsmith, representing rented vault space. If a man had more coin than he wished to carry from day-to-day, he might ask to deposit it with a smith. Since goldsmiths already had to secure their own wares, it made sense they would rent unused vault space. The owner of this gold would be given a written receipt, entitling him to withdraw upon request. For a long time, these were only redeemed by the owner. Over time, it became customary for the customer to endorse the receipt to a third party. Upon presentation, the endorsed receipt could be cashed in. This was an early form of modern-day checks.

Later, currency evolved naturally to a point that a series of small receipts, each adding up to the total, with “pay to the bearer upon demand” written at the top could be issued by the customers themselves.

Over time people became more and more comfortable using paper receipt currencies, and eventually they were conditioned to trust the institutions to redeem their receipts for money (gold) or coinage (commodity currency) upon demand. The paper currency was worthless, but as long as it could be redeemed for coin money, they both retained the same value. When the receipts were honored, the economy moved forward.

In the beginning, this receipt money represented a real underlying asset such as silver or gold, at a ratio of one to one. For every dollar of currency receipts issued, there was to be held a dollar’s worth of gold in a vault somewhere. This is an example of full-reserve banking.

Over time, the evolving group of “bankers” realized they could issue more receipt than they had coin to back it. Banks continued to “lend” and therefore expand the money supply. As long as not too many people demanded physical delivery of capital, the pyramid could continue indefinitely. Since most people who took loans didn’t want to carry around huge piles of coinage, they often took their loans in the form of paper receipts, which meant that rehypothication schemes could continue multiple-fold.

This form of money is known as fractional money. The early goldsmiths of Europe stored coins for folks, but eventually decided they should lend out other people’s money- effectively “double-spending” it. Bankers felt it such a pity for money to lay idle in a vault, when it could otherwise create “productivity” from nothing, profits for customers- and more importantly, the bank.

Since no more than 10-20 percent of customers typically withdrew their capital at once, banks decided they could lend out the other 80 percent or so and draw interest on it. At first, customers didn’t even know that their coinage was being lent. Of course the banks would only lend their own capital.

However, this was not the case. Whether or not the “money” was ever morally and ethically even existent to be lent out in the first place is an entirely separate discussion. As banks lent more money than their equity-absorbing capital base safely allowed, they put themselves in a position to not be able to withhold their obligations to depositors.

If too many people withdrew at once, a run on the bank would occur. In this scenario, the bank (the debtor) goes insolvent (bankrupt). Creditors (depositors) lose their claim to capital, and lessons are hopefully learned. This is the nature of fractional reserve currency, and it was once backed by a monetary layer of Gold reserves.

Society then decided fractional money wasn’t bad enough. The private-sector banks, fueled by greed, created massive booms and busts through expansion and contraction of credit. The people always lost, and the banks usually won. Every single dollar was owed to someone else, and they could draw interest off every dollar in the stack.

Essentially, fractional reserve banking enabled unbacked currency to be created out of nothing in the form of loans and credit- guaranteeing a demand for more loans, to create more currency, to satisfy the already existent debt obligations. If this paradox feels mind-numbing that’s because it is.

In late 1600’s England, with King William and Queen Mary unable to increase taxes or borrow, the Bank of England was formed to provide the financial requirements of an imperious government. The original Royal Charter of 1694, granted by King William and Queen Mary, boasted that the Bank was founded to 'promote the public Good and Benefit of our People'. Political scientists and monetary scientists from the emerging business of banking essentially decided they would create a money factory. The cabal that emerged created a 7 point plan.

The government would grant a charter to the monetary scientists to form a bank. The bank charter would give them a monopoly to issue bank notes which would serve as England’s paper currency. The bank could create “money” out of nothing, with only a fraction of this new currency backed by physical money. The monetary scientists at the bank would then lend the government all the money it needed. The money, created as loans, would be backed primarily by government debt (IOU’s). Although this money cost nothing to create out of nothing, the government would pay “interest” on that money at a rate of 8 percent. The government IOU’s would also be considered as reserves for creating more money for private commerce. These loans also earned interest, and the banks could collect on every debt instrument note it created out of nothing. This was the world’s first central bank. A magical money factory, powered by the “science” of money. If you care to learn more about this insane mechanism by which debt is monetized on behalf of civilization, I recommend reading The Creature from Jekyll Island, by G. Edward Griffith.

The Federal reserve is just another iteration of the same doomsday machine, expertly crafted in the fires of American politics. Since bank runs generally ended poorly for capital holders, they could not be tolerated. It made sense that a “lender of last resort” could be created to “provide liquidity” to “banks in need”. The public would allow the creation of a Central Bank in the US to “save the public from the dangers of unregulated banking”. And such is the story of our enslavement to fractional-reserve fiat currency.

After exploring where money science and banking has evolved from, we can begin to piece together an understanding of the insidious effects of the nature of banking. I believe that I have witnessed the gradual erosion of the “American Dream” during my lifetime, and I’m pretty sure it has a lot to do with fiat, fractional-reserve banking.

I was born in 1990. I grew up with dial-up internet as young as I can remember. I embraced e-mail without question, because it seemed like a natural progression. My generation was born internet-native with the entire world available to us, given enough careful dissection of that information. We were raised with the same systems and institutions that governed the world of our parents, only we had access to a check on the limiting paradigms of thought being forced upon us, in a way unlike any generation that has existed before.

With the development of Google and other information-indexing services on the world wide web, we could all-of-a-sudden challenge the lies told to us by friends, families, teachers, pastors, governments, and media. The degree of subjectivity and relativity of information is incredibly apparent to millennials, I believe. We have been forced to sort through a plethora of narratives, instead of being fed a single narrative that feels cohesive. There’s simply too many forms of media, advertising, and propaganda that exist.

In my lifetime I have watched rents explode from inconvenient to downright unmanageable. I’ve watched as large swaths of society have revolted, camped out on Wall- Street, and ended up homeless. I watched us fight an unconstitutional war, one that wasn’t approved by congress and that we didn’t have capital for. Nobody voted on raising taxes to fight Iraqis. Our government just stole our future from us. Why does my money seem to be worth less every year? I have lived through the decay of the cute, hip coffee shops and the honest businesses. Gone are the days of good people running businesses for the love of what they do, making an honest living. The over-financialization of our society is a cancer of greed, and it is ultimately this cancer which has already become terminal. It is all a symptom of the slow creep of fiat. An economic system of infinite growth based on the exploitation of finite resources necessary for life to exist will always fail. We are living it, and it’s terrifying.

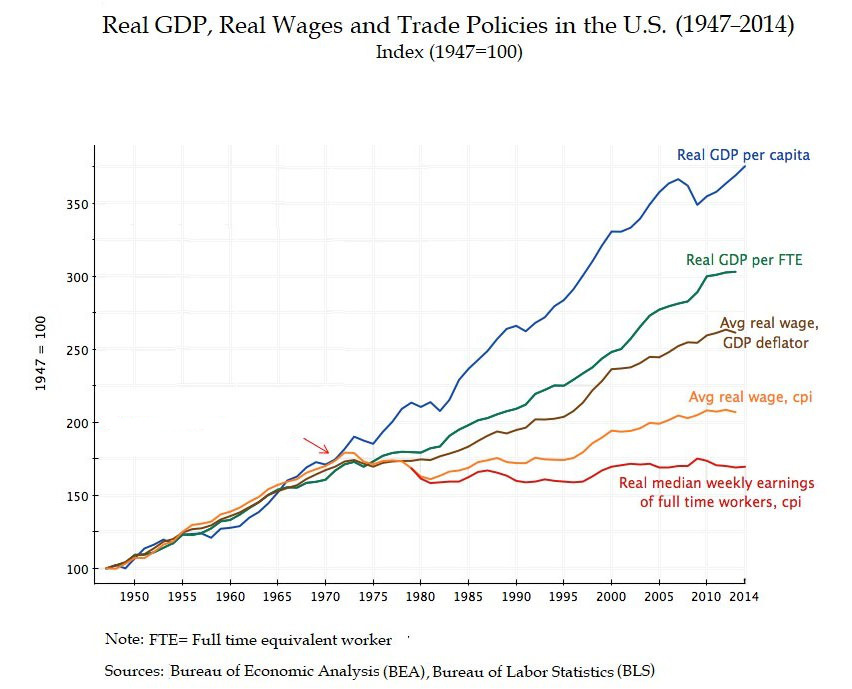

I’m sure that from the top things seem bright. As a young person witnessing the collapse of the American Empire, I want you to know that “We The People” are struggling. Since the inflation of the 1970’s, the Boomer generation did well for themselves. The 60/40 portfolio with a diversification into real estate has been highly successful. The models assumed that the price of real estate goes up forever, and it has, but I’m here to tell you the game has changed. People need to understand that fiat money forces you to gamble, to “outperform inflation”, which is really a symptom of decaying purchasing power brought about by money printing.

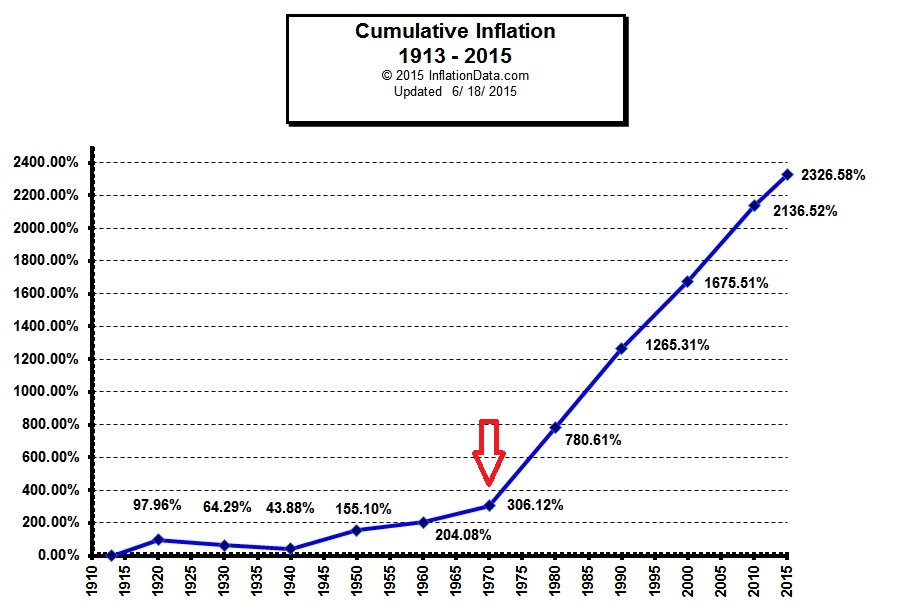

Try as we will, we are just working to sustain a pyramid scheme that is fracturing and collapsing in real time. The reason we will never outrun inflation from within the current system is that it is an exponential process.

If you look at the US National Debt, the M2 money supply, the US GDP, the US fiscal budget, etc... it all charts as logarithmic, not linear. This is a runaway freight train. It happens slowly at first, for a long time... and then suddenly.

If we look at natural systems, we can see other things with exponential progression- cancer, population, and bacterial growth. Exponential growth is unsustainable by nature and generally results in collapse, or death in living systems if allowed to persist unimpeded. Go back 100 years on a price chart of anything measured in dollars, and the exponential nature of money starts to expose itself. Prices are not going up, the value of the money is going down. But where is it going?

Boomers have been caught in the trap of the debt cycle. After fifteen years of zero-cost capital, the parasitic banking and political class that live off our efforts decided to “slow the economy”. Our neighbors, friends, and families who are used to booming business as usual are losing their homes, businesses, and land. They were conditioned to live outside their needs.

It has been glorified. Being able to “afford something” in the US, to most people, means they can service the debt payments for the financing. Being able to “afford something” used to mean that we actually had the means, without all the funny business. People who have profited off the US dollar Ponzi are coming in to scoop up all the leftovers, with the spoils of the Ponzi. Enough is enough folks. It’s time to talk about Revolution.

The US Constitution states “No state shall coin money, emit bills of credit, or make any thing but gold and silver coin a tender in payment of debts.” ~ Art. I, sec. 10, cl. 1. Libertarians have tried to use this to argue that paper money is, in fact, unconstitutional. While the case can be argued either way, the problem is that the “states” aren’t doing it, and the federal “government” isn’t either. The exorbitant privilege to issue currency on behalf of the populace has been delegated to private banks which share no pain in their creation of moral hazard.

Surely the forefathers did not intend our current system. Thomas Jefferson seemed to have strong feelings when he wrote to John Wayles Eppes in 1813: “Bank-paper must be suppressed, and the circulating medium must be restored to the nation to whom it belongs.”

Jefferson even showcased his understanding of the moral hazard of fiat when he wrote to John Taylor: “And I sincerely believe with you, that banking establishments are more dangerous than standing armies; and that the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale.”

I would like to add that as a baby, I did not agree to work for the rest of my life to pay the interest on the Iraq war, which was funded by an independently managed for-profit corporation which just-so-happens to have the “right” to print away my prosperity.

I will not fight too hard to make the case that fiat is unconstitutional, as any rational person who understands the nature of the beast must side with reason. George Washington laid it out quite directly “Paper money has had the effect in your state that it will ever have, to ruin commerce, oppress the honest, and open the door to every species of fraud and injustice.”

So, if our money is potentially unconstitutional and against everything the founding fathers stood for, what are we going to do about it?

The more I study finance and economics, the more I think that the battle for the soul of money has already been won. If I am right, this means something quite profound- on any significant time frame.

The longer that people hold onto their precious fiat, the less it will be worth. Don’t trust me on this, just try to figure out why. The game has already changed. Why? Because monetary technology has already evolved.

Bitcoin is an unstoppable, peaceful revolution in monetary technology. It will rip the current paradigm and bring the world to its knees, just in time to catapult us to a Type 1 Kardashev civilization. The process will be awkward and strange, but the fruits will be the rapid decentralization of society, a restoration of individual liberties, a separation of money and state, and empowerment of individualism.

Collectivism inspired by the Covid crisis has swept us away from ourselves, and it’s time to talk about personal responsibility. We need to be less reliant on the centralized systems that have a vested interest in controlling us. We need to strive to provide for ourselves. We need a return to American values. To do this, We The People must separate money and state.

The generations that preceded the present have quite negligently acted in their own self-interest. When the only incentive driving the allocation of capital is the reckless pursuit of profit, things get... well, reckless.

In the first two decades of the 2000s, the Fed manipulation of interest rates to zero combined with QE has been responsible for the largest misallocation of capital in the history of the world. We need a monetary reset, a return to sound money. We need it so badly that people are dying as a direct result of our fiat world every single day.

Symptoms include sovereign currency failures, destruction of natural resources, violent competition, famine, rolling blackouts, war, and austerity measures. Things we see as end-times in the West are everyday occurrences for much of the world. We must look our exorbitant privilege directly in the face and recognize that we, too, are complacent in the maliciousness of banks.

The politicians that get campaign donations from the money masters that were allowed to form a cartel by the privileged political class are not going to lead us to safety. If we want to stop a technocratic oligarchy that seeks to control, plan, and predict everything about our world, we need to recognize that time is running low.

Current trends in automation and robotics may leave large swaths of the population looking for purpose in the next ten years. The labor part of the labor/capital equation is quickly becoming less necessary.

When our global monetary system was established, we made a promise to keep it “sound” and uphold the gold standard. We broke that promise in 1971, and the system has been steered and manipulated by central planners ever since. This knowledge is important, but unless one has a solution it motivates people to exploit the system for their own survival or drown in existential dread. Such is the fate of an intelligent person.

Well… Suffer no longer my brother/sister. A group of people, or perhaps an individual, known only by the pseudonym Satoshi Nakamoto, studied years of progress in digital monetary systems and brought together multiple fields and technologies to create a very simple yet technologically complex invention.

It began with a monetary network called Bitcoin that solved the problem of double spending, which had previously been impossible with digital cash. Bitcoin was launched in January of 2009 on the heels of the Great Financial Crisis. This “great crisis” is insignificant in comparison to where we are today.

Bitcoin marks the creation of an economic system in which value is stored in a closed system where no new units of currency can be created arbitrarily- the rules of the game are set, public, and immutable.

The supply of new “coinage” being “mined” or brought into circulation is decreasing asymptotically by a factor of two, every four years, as the world wakes up to this fact.

If we examine Bitcoin closely, we will see that it has an exponentially increasing demand with a programmatically determined, exponentially decreasing supply.

The growth curve of Bitcoin’s supply is natural, like the human life cycle. We see programmatic, rapid growth upon inception that, as supply decreases exponentially over time, results in relative stabilization to a plateau of 21M total Bitcoins at a publicly known, algorithmically determined point in the future.

Since inception, Bitcoin has evolved from a nerd toy to a blackmarket asset to the best store of value asset ever invented. It is the only absolutely scarce commodity money the world has ever seen, secured and backed up by energy from every continent. It is quite literally the only absolutely scarce item in the known universe, made possible via computer code and mathematics.

As the dedicated “plebs” continue to be price-agnostic “buyers of last resort”, scooping up Bitcoin and HODLing it for better times, we know that a better future is possible, and we are doing this for future generations.

Many of us will not sell our Bitcoin for fiat, and the speculative market cycles will drive Bitcoin into the public consciousness. Adoption is imminent. Resistance is futile. All stranded energy in the world has the potential to be monetized because of this amazing technology. A feasible economic model for building out sustainable energy infrastructure becomes possible. Cheap, limitless energy is almost visible in the horizon.

While our leaders are busy trying to figure out how they can front-run this new power projection technology, Bitcoin completes a full audit of the blockchain, adds a new block, and keeps working exactly as intended every ten minutes.

What if Bitcoin continues working exactly as it has for the last fifteen years?

Bitcoin does not give a shit if leaders are nervous for the looming changes to the global monetary order. Bitcoin has come into the world. It already happened, and it is purpose-built money for trade between enemies in the digital age.

I have yet to meet an informed critic of Bitcoin. I think that will continue to be the case, until we’re all using Bitcoin. Once you take that orange pill, there is no going back.

Bitcoin is currently providing a path for African nations to escape the financial colonialism imposed on them by the Central African Franc.

Bitcoin is enabling cross-border payments without EU or US banks having to be involved, quelling part of the wealth-bleed induced by exploitation of Africa’s resources.

Bitcoin is enabling low-fee frictionless remittance payments, allowing working class families throughout the developing world to dump Western Union.

Bitcoin currently offers financial sovereignty to women in the 75 nations around the world where their freedom is curtailed because of their gender.

Bitcoin is non-censorable, so individuals can participate in protests and not fear having their finances frozen or confiscated. War refugees can flee war zones or oppressive regimes with capital controls, without having to fear their wealth will be confiscated at the border.

In the growing number of nations experiencing hyperinflation, Bitcoin can be used as a way to prevent government fiscal policy from eroding the value of money.

Hyperinflation can rapidly and very effectively nullify the value of decades of citizens work, keeping entire populations in poverty. Bitcoin gives the developing world the opportunity to leapfrog the West by bypassing the fiat banking system completely and migrating directly to a digital-native currency designed to support human freedom of movement, freedom of expression and freedom of financial sovereignty.

The contrast to this, CBDC’s, are coming fast... and they are terrifying. Bitcoin provides a safeguard against the erosion of basic human civil liberties such as the right not to be surveilled and the right to freedom of speech. Central Bank Digital Currencies at best fail to safeguard these freedoms and at worst could actively erode them. The humanitarian benefits of Bitcoin should be obvious.

Humor me, if you will, for one last adventure in thought. The basic unit of Bitcoin, 1/100 millionth of one Bitcoin, is known as a Satoshi, or sat. In ancient Sanskrit, it is my understanding that ‘sat’ is a common root word translated to mean several things.

Common meanings are “absolute truth”, “reality”, “Brahman”, “unchangeable”, “that which has no distortion”, “that which is beyond distinctions of time, space, and person”, and “that which pervades the universe in all its constancy”.

From this metaphor, I would like to convey that BTC may be universal “true money”.

Bitcoin fulfills the functions of money far better than fiat, and it is truly beyond the distinction of time, space, and people. It is the only money that you can quite literally take to the grave with you, and every sat “lost” donates it’s value, it’s “truth”, to the value proposition of everyone- true monetary scarcity. A monetary system that doesn’t bleed value. A monetary system that cannot be debased.

Bitcoin is a value system based on truth, fairness, and community. It is voluntary and opt-in. A better world is possible, where the value of your savings increases over time. The productivity increases of technology can enable the thriving of civilization instead of furthering its oppression, and the mutual development of prosperity is ensured because it is incentivized. I believe that the way we get there is by choosing to use a monetary system that requires a value-for-value exchange, peacefully taking the power to print money (and siphon capital from savers) from the banks and government.

For now we live in fiat times, and every single dollar that is printed into existence bears the weight of debt, a debt which is issued upon the soul of our nations’ youth. Government bonds are slavery bonds that payout yield from the future to capital holders now. We are literally selling our children into slavery. This dynamic further entrenches financial inequality and degrades the quality of life of those least able to protect themselves.

In closing, I’d like to single out all politicians. History is written by the victors… and Math is going to write this story. To any thinking individual, it is quite obvious that this ancient, imperial war-machine is broken. To understand how, we must grapple with several inconvenient truths.

To prove this, please share these Facts with a Candid World.

Synthesized Point:

Our world has evolved to a point where the current monetary system does not fulfill the needs of society. In actuality, it works to promote a mathematically guaranteed destruction of its participants. We must acknowledge the reality of the present in order to create a future in which our children are able to live on with any degree of dignity and prosperity. Please help us figure out how.